Wakala Fixed Deposit Account

Our Wakala Fixed Deposit Account offers a Shari’a compliant investment solution that provides you with a secure way to grow your savings over a fixed period of time, based on a Wakala agreement. If you are an existing client holding funds in a Current Account, you may wish to invest in a Wakala Fixed Deposit Account to earn profit on your funds in a manner consistent with Islamic finance principles.

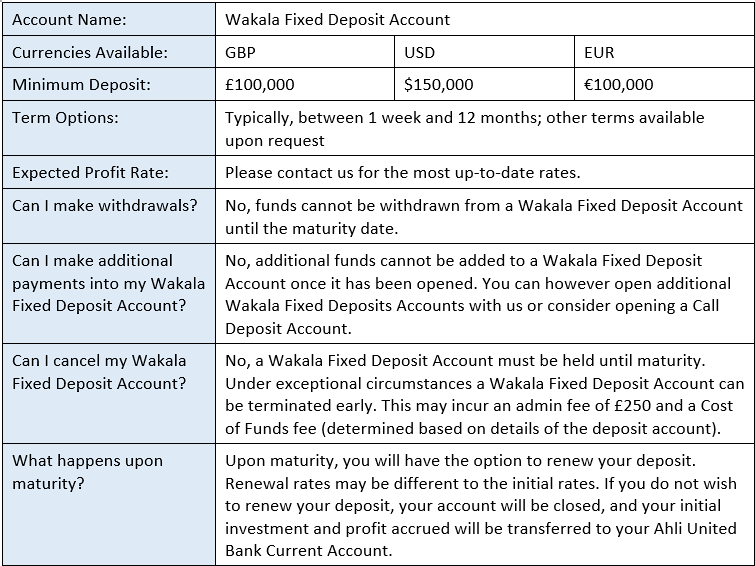

| Account Name: | Wakala Fixed Deposit Account | ||

|---|---|---|---|

| Currencies Available: | GBP | USD | EUR |

| Minimum Deposit: | £100,000 | $150,000 | €100,000 |

| Term Options: | Typically, between 1 week and 12 months; other terms available upon request | ||

| Expected Profit Rate: | Please contact us for the most up-to-date rates. | ||

| Can I make withdrawals? | No, funds cannot be withdrawn from a Wakala Fixed Deposit Account until the maturity date. | ||

| Can I make additional payments into my Wakala Fixed Deposit Account? | No, additional funds cannot be added to a Wakala Fixed Deposit Account once it has been opened. You can however open additional Wakala Fixed Deposits Accounts with us or consider opening a Call Deposit Account. | ||

| Can I cancel my Wakala Fixed Deposit Account? | No, a Wakala Fixed Deposit Account must be held until maturity. Under exceptional circumstances a Wakala Fixed Deposit Account can be terminated early. This may incur an admin fee of £250 and a Cost of Funds fee (determined based on details of the deposit account). | ||

| What happens upon maturity? | Upon maturity, you will have the option to renew your deposit. Renewal rates may be different to the initial rates. If you do not wish to renew your deposit, your account will be closed, and your initial investment and profit accrued will be transferred to your Kuwait Finance House PLC Current Account. | ||

Further details can be found in the Wakala Fixed Deposit Account Summary Box (GBP), Wakala Fixed Deposit Account Summary Box (USD), Wakala Fixed Deposit Account Summary Box (EUR) and Tariff of Charges page.

• You must already have a Current Account with Kuwait Finance House PLC to open a Wakala Fixed Deposit Account

• You must be 18 years old or above

• We serve clients who reside in the Gulf Cooperation Council regions and most Middle East & North Africa countries, or clients who reside outside these regions and have an association with these regions, such as a business or source of wealth

• A minimum deposit of £100,000, $150,000 or €100,000 is required to open a Wakala Fixed Deposit Account.

Please note: We also offer Corporate Deposit Accounts for business clients. For more information, please contact us.

• Sharia-Compliant Investment: Your deposit will be managed according to a Wakala agreement, where we act as your agent to invest your funds in Shari’a compliant activities

• Generate Profit: Lock in a competitive expected profit rate for the full term of your deposit, providing returns on your investment.

• Flexible Terms: Choose from a range of deposit terms to suit your financial goals, from short-term investments of 1 week to longer commitments of 12 months or longer (upon request).

• Currency Options: Open your term deposit in GBP, USD or EUR to align with your financial preferences.

• Easy Setup: Wakala Fixed Deposit Accounts can be set up quickly and easily by contacting your dedicated Relationship Manager.

• Secure Investment: Your funds are held securely for the duration of the term, with protection up to £85,000 through the Financial Services Compensation Scheme.

Vulnerable customers

At Kuwait Finance House PLC, we understand that vulnerability can come in various forms—be it health, financial, situational, or capability-related challenges. We are here to ensure that every client, especially those who are vulnerable, receives fair treatment, clear communication, and tailored support to manage their finances effectively.

If you need additional support for whatever reason, please do let us know, so we can ensure your personal needs and circumstances are taken into consideration. Get in touch on the telephone number or email address below, or visit us at our London branch.

Protecting your money

Your eligible deposits held by a UK establishment of Kuwait Finance House PLC are protected up to a total of £85,000

by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme.

Any deposits you hold above the limit are unlikely to be covered.

Please click here FSCS Leaflet: How FSCS protects your money for further information or visit www.fscs.org.uk

You can also refer to our FSCS Information Sheet for more details.

How to apply

To apply for a Wakala Fixed Deposit Account, you will need to have a Current Account with Kuwait Finance House PLC. For more information on opening a Current Account with Kuwait Finance House PLC, click here.

How can I open an Account ?

Please call us at +44 (0) 20 7487 6500, email at info.kfhplc@kfh.com, or visit our London branch at 35 Portman Square, London, W1H 6LR. For more information click on the Contact Us button below.